California’s population has begun growing again – ever so slightly. But will the housing supply ever catch up?

The cost of housing in California increased sharply during the early part of the COVID pandemic – as it did in many places. Now, even though housing growth has been sluggish, cost has levelled off. There are probably several reasons for this, not the least of which is the rapid rise in interest rates. But there may be another factor: The supply of housing, sluggish though it may be, is growing faster than the population.

In 2023, according to the Department of Finance, California’s population grew by 67,000 people – the first increase since the pandemic began and the state’s population began declining. But the amount of housing grew by double that amount – 120,000 units or so. That’s a far cry from the half-million or more that Gov. Gavin Newsom said was needed was he first ran for office in 2018, but it’s still an increase.

To take a longer view, CP&DR looked at DOF’s estimates of change in population versus change in housing units since the 2020 Census – almost four years, during most of which California’s population declined. And the bottom line is that during that time, the supply of housing increased by 3% and the population declined by 1%.

In 2020, there were 39,538,000 people in California and 14,392,000 housing units – in other words, one housing unit for every 2.75 Californians. Four years later, there were 39,128,000 people – a drop of 400,000, or about 1%. And there were 14,824,000 housing units – an increase of 450,000 units, or about 3%. And the ratio had changed to one housing unit for every 2.64 Californians.

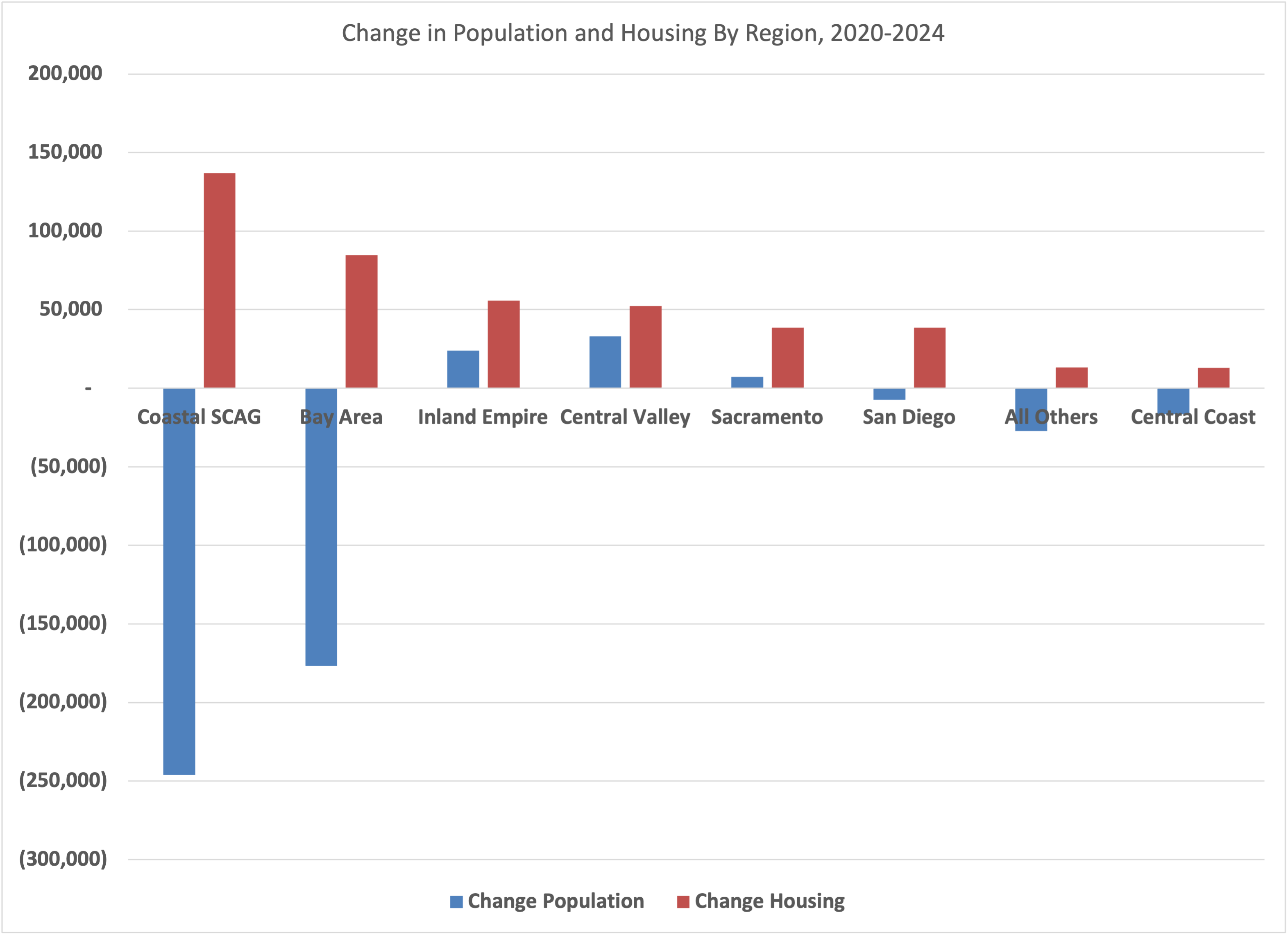

Between 2020 and 2024, the differential was most noticeable in California’s two huge metropolitan areas – coastal Southern California (Los Angeles/Orange/Ventura Counties) and the Bay Area.

Coastal Southern California lost almost a quarter-million people – but gained 136,000 housing units. The Bay Area’s performance was proportionally almost identical – a loss of 176,000 people and a gain of 84,000 housing units.

Unsurprisingly, the inland areas showed steadier population levels and higher housing growth. The Inland Empire added 0.5% to its population and 3.5% to its housing supply. (The population growth was all in Riverside County – San Bernardino County actually lost population.) The Central Valley added 0.8% in population and 3.9% in housing units while Sacramento added 0.3% in population but 3.9% in housing units – the highest total anywhere in the state.

An interesting outlier was San Diego County, which showed a very minor population loss but still added 3.1% to its supply of housing units – a bigger increase than either the Bay area or the L.A. area. The increase in housing may be partly the result of the City of San Diego’s aggressive pro-housing policies, but the fact that the population held steady may account for the region’s persistently high housing prices.

A longer-term perspective shows how the components of needed housing supply have changed over the past few decades. It’s an article of faith among housing advocate that California has underproduced housing since around 1990, when a big recession and the first big group of local growth control ordinances first kicked in. But the ratio of population to housing really hasn’t changed much. In 1990, California had about 29.8 million people and 11.2 million housing units – about 2.66 people per housing unit, or almost exactly the same as today. In fact, between 1990 and 2024, the state added 9.4 million people and 3.6 million housing units, or about 2.57 people per housing unit.

The perceived shortage – and the increase in prices – are the result of a wide variety of factors. New houses are bigger and more expensive and new apartments are more amenity-driven and almost more expensive. Empty-nesters tend to sit on their houses these days, especially if they have low Proposition 13 taxes and low Trump-era interest rates. And household formation is different than in past generations: lower fertility rates, smaller household sizes, established empty-nesters living longer.

So the bottom line is that the current housing crisis isn’t entirely the result, strictly speaking, of fewer housing units being built. It’s also the result of rapidly changing social and demographic trends bumping up against housing trends – both in new construction and the market supply of older homes – that change much more slowly.

This blog came to you courtesy of California Planning & Development Report, the authoritative source for land-use planning news in California. Check out our subscription packages here.

The AICP CM credit deadline is coming up! Get AICP CM credit for Bill Fulton’s one-hour course on RHNA and the Housing Element in California,.For more, just click here.