California’s housing cost is still the highest in the nation and Sacramento is still focused on increasing housing production. And although overall production has not gone up much in recent years, it’s outpacing population growth – at least according to the demographers at the California Department of Finance.

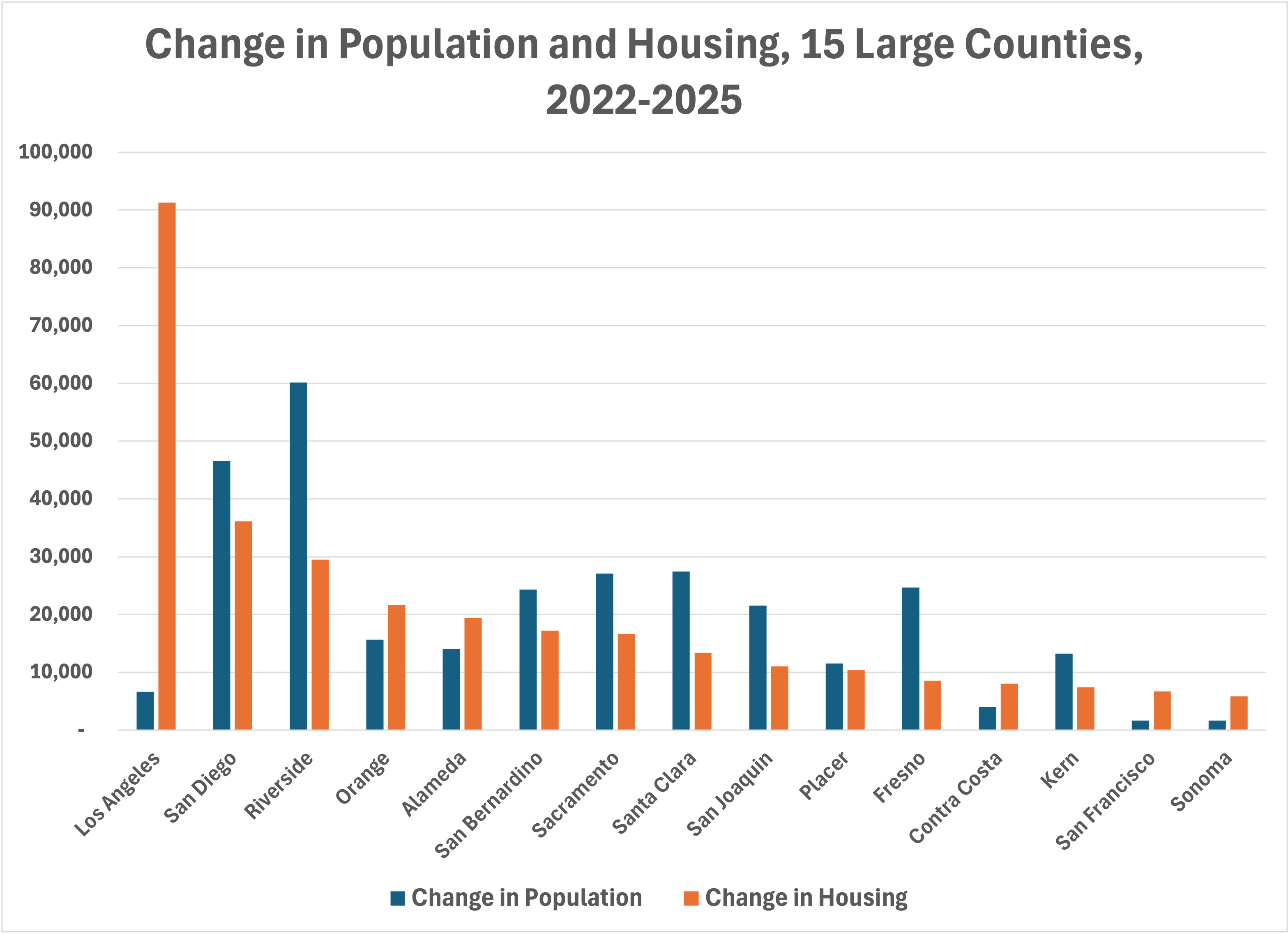

The latest numbers show that between 2022 and 2025, California added one new housing unit for every resident – 349,000 new people and 364,000 new housing units, or a little over 100,000 each per year. A quarter of those units were built in Los Angeles County even though the population barely moved at all, while second place – far behind – went to San Diego County.

Most of the population and housing growth – 300,000 out of around 360,000 -- came in 15 large counties. But there was a big difference in the type of housing, and the population composition, between coastal and inland counties.

Of the 15 counties with the largest population and housing increases, eight were in coastal areas (including the Bay Area) and seven were in inland areas. But the differences were notable:

- In the eight coastal counties, housing growth was almost double that of population growth – 202,000 compared to 117,000. Almost half of the housing growth in these eight counties came in Los Angeles County.

- In the seven inland counties, the trend was the opposite. Population growth was almost double housing growth, 182,000 to 100,000. For example, Riverside County added 60,000 residents – most in the state – but only 29,000 housing units.

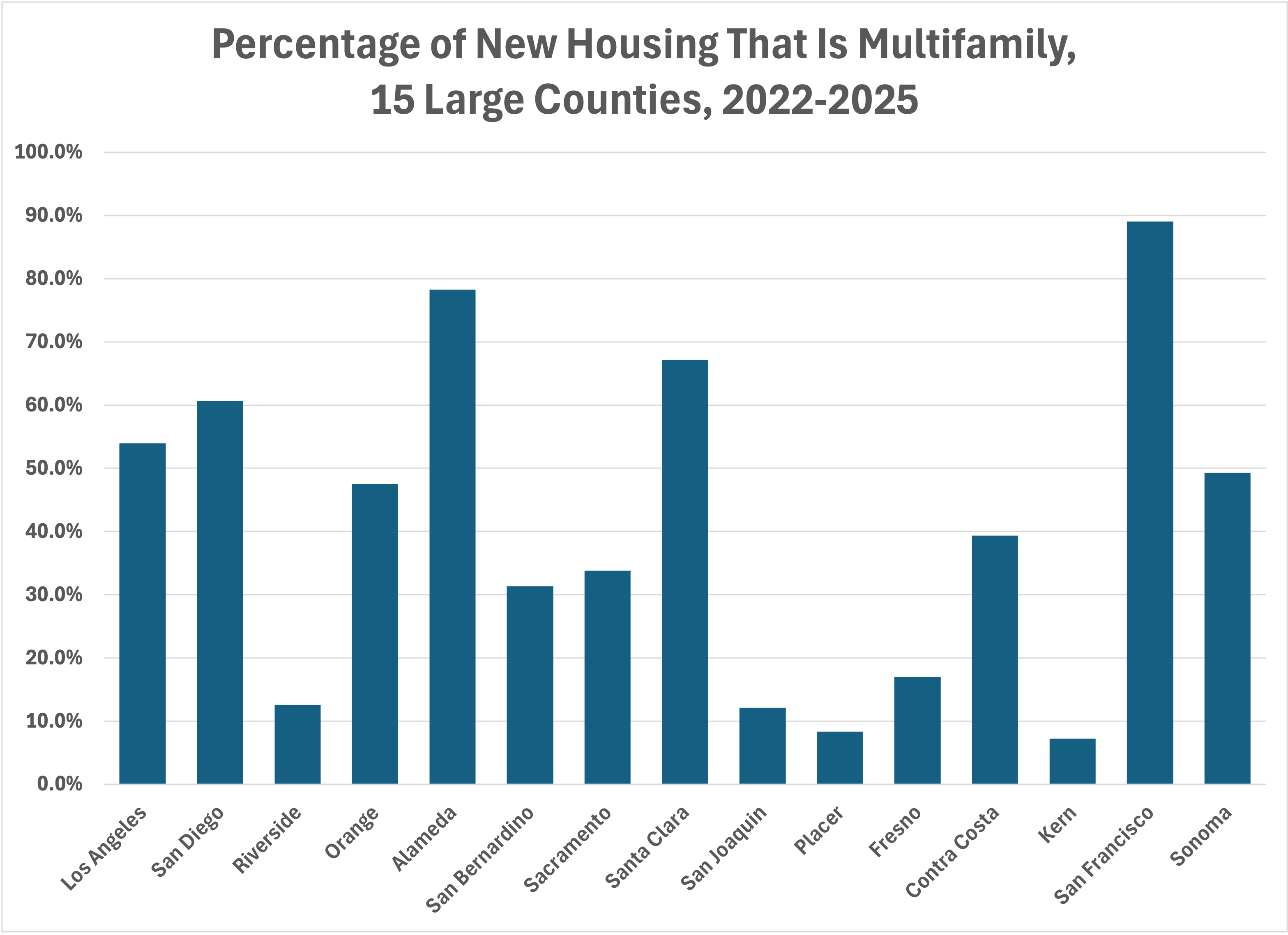

Part of the reason for this difference, of course, was housing type. In the coastal counties, about 117,000 of the 200,000 new housing units were multifamily, while in the inland areas, about 80,000 of the 100,000 new units were single-family. Statewide, 43% of new units were multifamily, a significant increase over the 2022 overall statewide number of 31%.

Among coastal counties, multifamily units in Alameda – which has seen aggressive prohousing policies in places like Oakland, Emeryville, and Berkeley – accounted for 80% of new units. Santa Clara County saw 67% multifamily and San Diego 60%. Some “coastal” counties with significant greenfield inland areas, including Los Angeles and Contra Costa, hovered around 50-50.

Meanwhile, in Riverside County, only 12.6% of new units were multifamily.

San Francisco and Kern had almost the same number of units built but were complete opposites in housing type. The SF/MF split in San Francisco was 89/11, while in Kern is was 7/93.